What Is Critical Illness Insurance And How Does It Work?

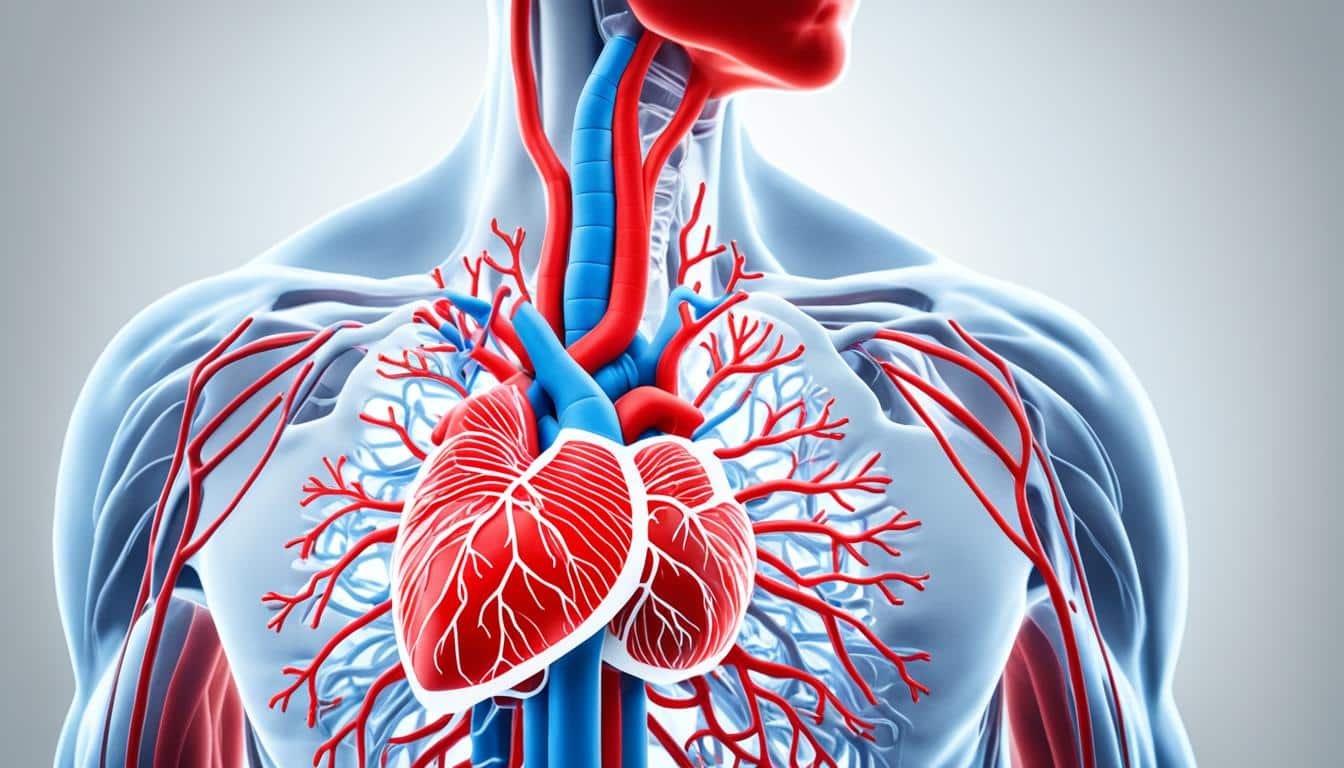

Critical illness insurance is an add-on to your regular health coverage. It pays out if you’re diagnosed with a serious condition. It gives you a lump sum or monthly payments. This money helps with extra costs not covered by standard health insurance during your recovery. This insurance typically includes cancer, heart attacks, strokes, and organ … Read more